Mergers and acquisitions (M&A) have become commonplace in today’s business landscape, offering companies a pathway to expand, diversify, and gain a competitive edge. However, the true measure of success in M&A lies in the ability to seamlessly integrate the acquired entity’s systems and processes into the existing organizational framework. A well-planned and executed integration strategy not only streamlines operations but also unlocks the full potential of the combined entity.

While M&A offers tremendous growth prospects, it is vital to approach integration with careful consideration and a human touch. Harmonizing diverse technologies, and operations requires a well-thought-out plan that values the contributions of employees and ensures smooth collaboration across all levels.

In the following sections, we will delve into key strategies that have proven to be effective in post-M&A integration, accompanied by real-life examples and use cases. From crafting a comprehensive integration plan to leveraging flexible integration technologies, each strategy serves as a stepping stone toward a successful consolidation.

We will explore the critical role of data integration and data quality in making informed business decisions and earning customer trust. In addition, we will uncover how business process reengineering can optimize workflows, eliminate redundancies, and improve overall efficiency.

This article will also highlight the transformative potential of Integration Platforms as a Service (iPaaS) in the context of M&A consolidation. As cloud-based integration platforms, iPaaS solutions offer seamless data exchange and process integration, facilitating smoother and faster integration.

Aonflow iPaaS – Free for First 3 Months!

Build and run up to 1,500 transactions monthly with no cost. No payment info needed!

Mergers And Acquisitions And The Need For Their Integration Strategies

Mergers and Acquisitions (M&A) refer to the consolidation of two or more companies, where one entity absorbs or combines with another to form a single, larger organization. While mergers involve the mutual agreement of two companies to merge into a new entity, acquisitions involve one company purchasing the assets, stocks, or equity of another, making the latter a part of the acquiring company.

The primary need for integration strategies in mergers and acquisitions arises from the inherent complexities involved in bringing together two distinct entities and ensuring their seamless operation as a unified whole. When two companies merge or when one acquires another, they often come with different organizational cultures, systems, processes, technologies, and even business objectives. Without careful planning and execution, the integration process can result in inefficiencies, redundancies, and conflict, undermining the very purpose of the M&A deal.

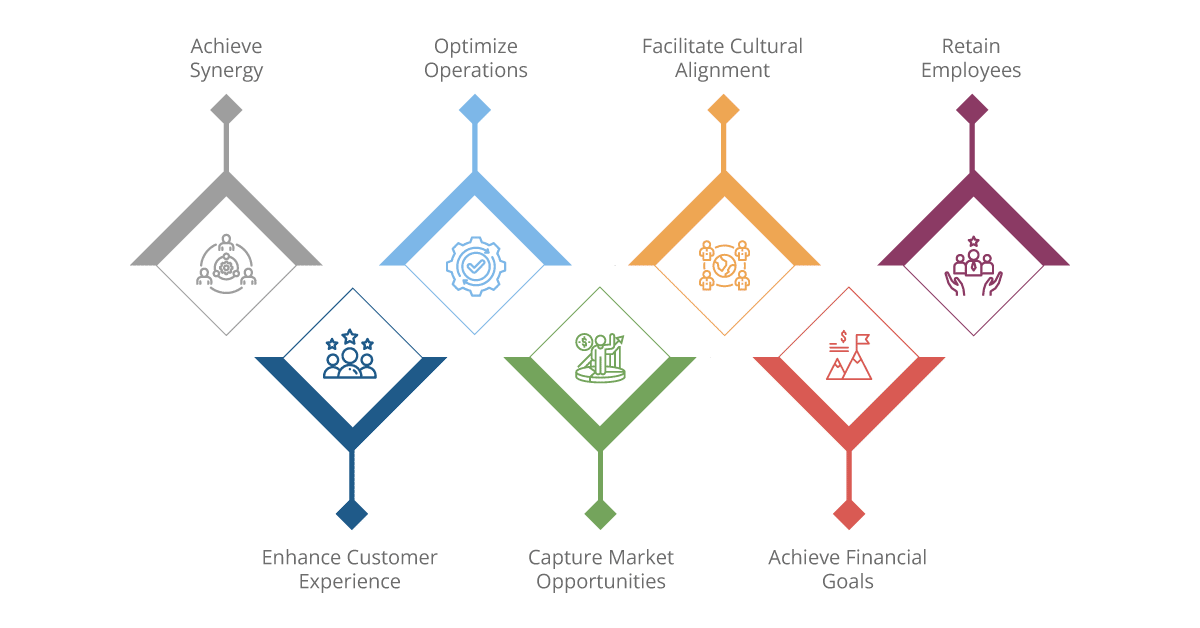

Integration strategies are essential to:

Achieve Synergy: The main motivation behind most mergers and acquisitions is to achieve synergy – the idea that the combined entity will be more valuable and profitable than the sum of its parts. Effective integration strategies aim to capitalize on the strengths of both entities and eliminate redundancies to create a cohesive and efficient organization.

Optimize Operations: Consolidating systems and processes through integration ensures that the newly formed entity operates smoothly and efficiently. By harmonizing business practices, the organization can reduce costs, improve productivity, and enhance overall performance.

Facilitate Cultural Alignment: Organizational culture plays a crucial role in the success of any integration. A well-thought-out integration strategy focuses on aligning cultural values, norms, and practices to create a unified and motivated workforce.

Retain Employees: M&A deals can create uncertainty among employees, leading to potential talent loss. Integration strategies must address talent retention, providing employees with a clear roadmap and support during the transition to retain key personnel.

Enhance Customer Experience: M&A integration should aim to maintain or improve the level of service provided to customers. By streamlining processes and ensuring data accuracy, the integrated entity can deliver a consistent and enhanced customer experience.

Capture Market Opportunities: Integration strategies help organizations seize market opportunities more effectively. By leveraging the strengths of both entities, the integrated company can expand its market reach and gain a competitive advantage.

Achieve Financial Goals: The success of any M&A deal is ultimately measured by its impact on financial performance. Integration strategies focus on optimizing financial structures, eliminating redundancies, and maximizing revenue streams to achieve set financial goals.

Mergers and acquisitions offer significant opportunities for companies to grow, expand, and thrive. However, achieving success in M&A requires thoughtful planning and the implementation of robust integration strategies. Addressing the need for cultural alignment, process optimization, talent retention, and customer-centricity enables organizations to harness the full potential of their M&A endeavors and pave the way for sustainable growth and success in a competitive business environment.

Essential Integration Strategies for Mergers and Acquisitions

Develop a Holistic Integration Plan:

A well-crafted integration plan serves as the backbone of a successful merger or acquisition. It should encompass all aspects of the integration, including cultural integration, technology alignment, process harmonization, and communication strategies. A clear roadmap with defined milestones ensures that the integration process stays on track and that everyone involved is on the same page.

Example: Let’s say when Company A acquired Company B, they recognized the significance of a comprehensive integration plan. They formed cross-functional integration teams, each responsible for specific aspects of the integration, such as HR, IT, and finance. This approach enabled them to maintain focus, address challenges proactively, and foster a collaborative environment.

Prioritize Cultural Alignment:

Cultural integration is often an overlooked yet crucial aspect of M&A success. Companies with diverse cultural backgrounds may have different ways of working, communicating, and making decisions. Understanding and aligning the cultures of both organizations can lead to a more harmonious integration, where employees feel valued and motivated to contribute to the new entity’s success.

Example: Let’s assume when Company X merged with Company Y, they conducted workshops and team-building activities to bridge the cultural gap. Leaders from both entities actively participated, fostering open dialogue and building trust among the employees. As a result, the integrated company witnessed increased employee engagement and a stronger sense of unity.

Focus on Data Integration and Data Quality:

Data integration is fundamental to achieving a single source of truth in an integrated entity. Consolidating customer data, financial records, and other critical information from both companies ensures data accuracy and supports informed decision-making. Additionally, ensuring data quality through data audits and governance processes enhances the integrity of the information being used.

Example: Imagine Company Z, after the acquisition of a smaller company, faced challenges with data inconsistencies between their CRM systems. By implementing a data integration platform and conducting rigorous data cleansing exercises, they established a unified customer database, resulting in improved sales forecasting and targeted marketing campaigns.

Leverage Scalable and Flexible Integration Technologies:

Modern integration technologies, such as cloud-based Integration Platforms as a Service (iPaaS), offer scalable and flexible solutions for consolidating systems and processes. iPaaS platforms enable easy data exchange, application integration, and workflow automation, allowing companies to adapt quickly to changes and scale their operations efficiently.

Example: Picture Company M, after acquiring a tech startup, integrated their disparate IT systems using an iPaaS solution. This integration allowed for seamless data flow between sales, marketing, and customer service departments. Consequently, the company achieved streamlined operations, reduced manual work, and accelerated customer response times.

Emphasize Business Process Reengineering:

Business process reengineering (BPR) involves reimagining and redesigning existing processes to optimize efficiency and reduce redundancies. By aligning workflows with the newly formed organization’s objectives, companies can eliminate inefficiencies and create a more agile and competitive entity.

Example: Imagine Company P, after a merger with a regional player, used BPR to optimize its supply chain. By reevaluating inventory management practices and implementing automated replenishment processes, they significantly reduced inventory holding costs and improved order fulfillment timelines.

Provide Comprehensive Employee Training:

Employees play a central role in the success of integration. Providing them with comprehensive training and resources helps them adapt to changes smoothly and embrace the new systems and processes. Empowered employees are more likely to contribute actively to the integration’s success and remain committed to the long-term goals of the integrated entity.

Example: Assume Company Q, post-acquisition, organized training sessions to familiarize employees with the integrated technology stack. They also provided ongoing support and access to training materials, enabling employees to navigate the changes confidently. This approach led to a shorter learning curve and improved overall productivity.

The success of mergers and acquisitions hinges on effective integration strategies that consolidate systems and processes seamlessly. A well-designed integration plan, cultural alignment, data integration and quality, flexible integration technologies, business process reengineering, and comprehensive employee training are crucial components of a successful integration journey.

Prioritizing these strategies and learning from real-world examples enables companies to foster synergy, achieve operational efficiencies, and position themselves for long-term success in the ever-changing business landscape. The integration process is not without its challenges, but with careful planning and commitment to fostering collaboration, the integrated entity can emerge stronger, more resilient, and well-positioned to thrive in a competitive marketplace.

Key Strategies for Post-M&A Integration

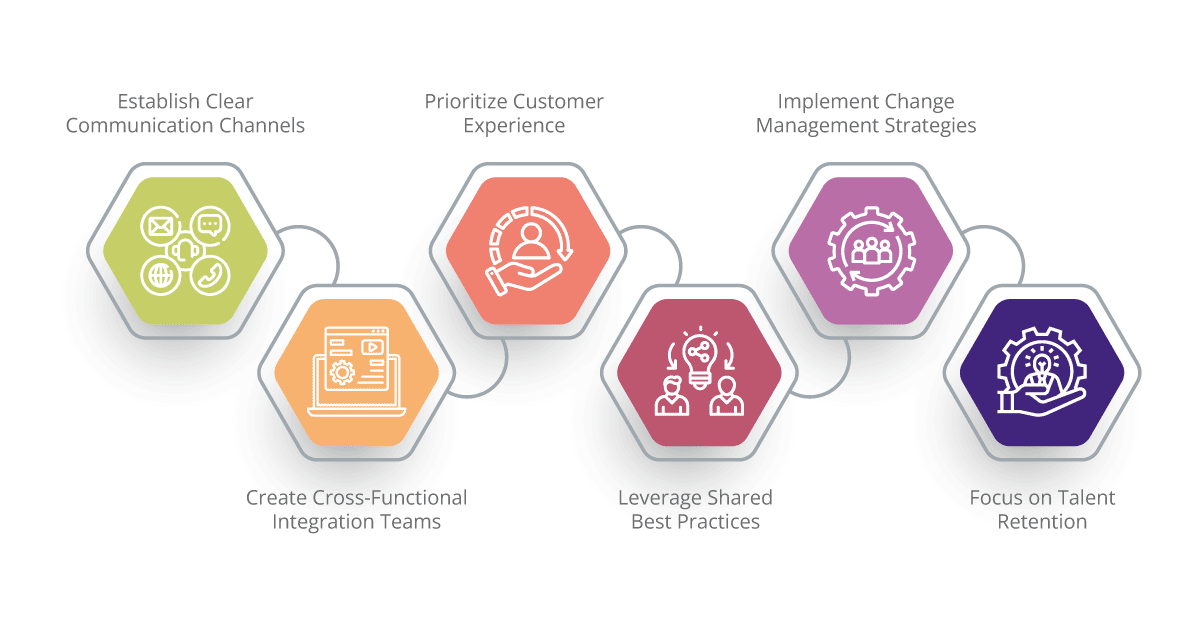

Establish Clear Communication Channels:

Effective communication is the cornerstone of successful integration. Open and transparent communication channels help address concerns, dispel rumors, and keep employees informed about the integration process. Regular updates from leadership reassure employees and foster a sense of trust and stability during the transition.

Create Cross-Functional Integration Teams:

Forming cross-functional teams that comprise employees from both companies facilitates seamless integration. These teams collaborate to address specific integration challenges, such as IT systems integration, cultural alignment, and customer onboarding. Cross-functional representation ensures diverse perspectives and facilitates effective decision-making.

Prioritize Customer Experience:

Maintaining a consistent and positive customer experience during integration is crucial to retaining customer loyalty. Companies should develop a customer-focused integration plan to ensure that customer interactions, service levels, and support remain uninterrupted and of high quality.

Leverage Shared Best Practices:

Identifying and leveraging best practices from both companies can lead to enhanced efficiency and performance. Integrating the best processes, technologies, and methodologies from each entity fosters a culture of continuous improvement and knowledge-sharing.

Implement Change Management Strategies:

Integration often involves significant changes for employees, ranging from new reporting structures to altered roles and responsibilities. Effective change management strategies help employees adapt to these changes, reducing resistance and increasing acceptance of the integrated entity.

Focus on Talent Retention:

Talent retention is crucial during integration, especially for key employees who possess critical skills and knowledge. Identifying and incentivizing top performers ensures that the integrated entity retains its core competencies.

Aonflow is the leading integration platform.

You can kick-start by integrating your first-ever workflow in just a matter of minutes.

The Critical Role of Data Integration and Data Quality in Making Informed Business Decisions and Earning Customer Trust

Data has become an invaluable asset in this digital era, driving strategic decision-making, operational efficiency, and customer-centric initiatives. For companies engaged in mergers and acquisitions (M&A), data integration and data quality play a pivotal role in consolidating systems and processes and creating a unified and reliable source of information. Here, we explore the critical importance of data integration and data quality in the post-M&A integration phase and their profound impact on making informed business decisions and earning customer trust.

Creating a Single Source of Truth:

Data integration involves combining data from disparate systems, applications, and databases into a single, unified view. During M&A integration, companies often inherit multiple legacy systems and databases from the entities involved. Without proper data integration, valuable insights can be buried in siloed data, leading to confusion, inefficiencies, and uninformed decision-making.

By achieving data integration, the integrated entity gains a consolidated and harmonized data environment. This “single source of truth” ensures that all stakeholders have access to accurate, up-to-date information, enabling them to make well-informed decisions based on reliable data.

Supporting Business Intelligence and Analytics:

Data integration is essential for enabling robust business intelligence and analytics capabilities. Consolidating data from various sources facilitates comprehensive data analysis, generating actionable insights that drive strategic planning and operational improvements.

Leveraging Data Quality:

Data quality is a fundamental aspect of maintaining a positive customer experience. Inaccurate or outdated customer data can lead to errors in customer communications, duplicate records, and misunderstandings, eroding customer trust and loyalty.

By ensuring data quality through regular data cleansing, deduplication, and validation processes, companies can deliver personalized and reliable customer experiences. Accurate customer data enables targeted marketing, personalized support, and seamless interactions across various touchpoints, fostering customer trust and loyalty.

Facilitating Compliance and Risk Management:

Data integrity and accuracy are critical for meeting regulatory requirements and managing business risks effectively. Inaccurate or inconsistent data can lead to compliance violations, financial losses, and reputational damage.

Data integration ensures that data is consistent across systems and adheres to compliance standards. Robust data quality measures prevent errors and discrepancies, supporting accurate financial reporting and risk assessment.

Enabling Predictive and Prescriptive Analytics:

Data integration and data quality also pave the way for advanced analytics techniques, such as predictive and prescriptive analytics. These techniques use historical and real-time data to anticipate future trends, identify potential issues, and recommend optimal courses of action.

Data integration and data quality are indispensable elements in the post-M&A integration phase. By consolidating data from diverse systems, companies create a single source of truth that empowers informed decision-making, fosters strategic planning, and enhances customer experiences. Robust data quality measures ensure the accuracy, reliability, and compliance of data, enabling organizations to mitigate risks and achieve operational excellence.

By embracing data integration and data quality as essential components of the integration strategy, companies can earn customer trust through personalized experiences, improve decision-making through data-driven insights, and create a unified and efficient entity that thrives in a competitive business landscape. As data continues to be the lifeblood of modern businesses, its strategic management becomes a crucial factor in the long-term success of post-M&A integration endeavors.

How Business Process Reengineering Can Improve Overall Efficiency

Business Process Reengineering (BPR) is a systematic approach aimed at redesigning existing business processes to achieve dramatic improvements in efficiency, productivity, and overall performance. In the context of mergers and acquisitions (M&A) integration, BPR plays a crucial role in streamlining workflows, eliminating redundancies, and driving operational excellence. Here, we explore how BPR can optimize workflows, remove inefficiencies, and improve overall efficiency during the post-M&A integration phase.

Streamlining Workflows:

BPR involves analyzing and reimagining the entire flow of a business process, from its initiation to completion. During M&A integration, companies often inherit multiple, sometimes conflicting, workflows from the merging entities. By reengineering these workflows, the integrated company can create more straightforward, leaner processes that deliver the desired outcomes with minimal delays and wastage.

Identifying and Eliminating Redundancies:

Inefficiencies caused by redundant activities can be a significant drain on resources and hinder productivity. BPR entails identifying and eliminating redundant tasks or steps, ensuring that the integrated organization operates more efficiently and with reduced operational costs.

Leveraging Technology and Automation:

BPR emphasizes the strategic use of technology and automation to simplify and expedite processes. Automation can handle routine, repetitive tasks, freeing up employees to focus on more value-added activities.

Encouraging Cross-Functional Collaboration:

BPR often necessitates breaking down silos and promoting cross-functional collaboration. By involving stakeholders from different departments in the process of reengineering efforts, companies foster a shared understanding of end-to-end processes and encourage teamwork.

Measuring and Monitoring Performance:

BPR involves setting clear performance metrics to gauge the success of the re-engineered processes. Regular monitoring and measurement enable continuous improvement, identifying areas for further optimization and refinement.

Emphasizing Customer-Centricity:

During BPR, customer needs and preferences take center stage. Processes are redesigned with a focus on enhancing the customer experience, resulting in improved customer satisfaction and loyalty.

Business Process Reengineering is a powerful tool in the post-M&A integration phase, enabling organizations to optimize workflows, eliminate redundancies, and improve overall efficiency. By streamlining processes, leveraging technology, promoting collaboration, and measuring performance, companies can create a lean, agile, and customer-centric organization.

BPR aligns the integrated entity’s operations with strategic goals, ensuring that it remains competitive, responsive, and adaptable in a dynamic business environment. Through BPR-driven process optimization, companies can unleash the full potential of their M&A endeavors, leading to sustained growth, improved productivity, and a stronger market position.

The Transformative Potential of iPaaS in M&A Consolidation

iPaaS has emerged as a transformative solution in the context of mergers and acquisitions (M&A) consolidation. iPaaS offers a cloud-based, scalable, and flexible integration platform that enables seamless data exchange, application integration, and process synchronization between different systems. This transformative technology plays a critical role in accelerating the integration process, maximizing synergies, and achieving long-term success. Let’s explore several use cases that highlight the significant impact of iPaaS in M&A consolidation.

Simplifying Data Integration:

Use Case: Company A acquires Company B, both operating on different CRM and ERP systems. iPaaS provides pre-built connectors and APIs that facilitate data integration between these disparate systems. With iPaaS, the integrated entity gains a unified view of customer data, order history, and financial information, enabling better decision-making and improved customer service.

Accelerating Time-to-Value:

Use Case: Company X merges with a regional competitor to expand its market presence. By adopting an iPaaS solution, they rapidly connect their e-commerce platform with the acquired company’s inventory management system. This integration reduces the time required to synchronize product catalogs and stock levels, allowing Company X to capitalize on the acquisition’s potential and gain a competitive edge in the market quickly.

Ensuring Scalability and Flexibility:

Use Case: A multinational corporation acquires a startup with innovative technology. iPaaS allows seamless integration of the startup’s cutting-edge software with the acquiring company’s existing ecosystem. As the business grows, iPaaS effortlessly accommodates increased data flow and transaction volume, ensuring scalability without costly infrastructure upgrades.

Enhancing Collaboration:

Use Case: Company Z undergoes a merger and needs to integrate various collaboration tools, messaging platforms, and document-sharing systems. iPaaS acts as the central hub, enabling real-time data sharing and process synchronization across departments, improving internal communication, and fostering a collaborative culture within the integrated entity.

Enabling Real-time Insights:

Use Case: After a merger, Company Y aims to analyze sales performance in real time across all subsidiaries. iPaaS connects data from point-of-sale systems to a centralized analytics platform, providing up-to-date insights on sales trends, inventory levels, and customer preferences. With timely information, Company Y can respond proactively to market fluctuations and capitalize on new opportunities.

Facilitating Cross-Functional Workflows:

Use Case: A global company acquires a regional player to expand into new markets. iPaaS connects their sales, logistics, and supply chain systems, enabling seamless cross-functional workflows. This integration streamlines order fulfillment, reduces delivery lead times, and optimizes inventory management, resulting in enhanced customer satisfaction and cost savings.

Integrating Customer Support Systems:

Use Case: Company M acquires a customer support-focused startup to improve customer service capabilities. iPaaS integrates the acquired startup’s helpdesk software with Company M’s CRM system. This integration ensures a 360-degree view of customer interactions, enabling personalized support and timely issue resolution, leading to higher customer retention.

Harmonizing HR and Payroll Processes:

Use Case: After a merger, Company P needs to integrate HR and payroll functions across entities. iPaaS connects the HRIS (Human Resources Information System) with the payroll system, automating employee data updates and ensuring accurate payroll processing. This integration reduces administrative burden, minimizes errors, and improves overall workforce management.

iPaaS offers transformative potential in M&A consolidation, revolutionizing the way data and processes are unified within the integrated entity. From simplifying data integration to accelerating time-to-value, ensuring scalability, enhancing collaboration, enabling real-time insights, and harmonizing workflows, iPaaS empowers businesses to achieve seamless integration and unlock the full potential of their M&A endeavors.

Through the numerous use cases presented, it is evident that iPaaS plays a pivotal role in achieving operational efficiencies, cost savings, and improved customer experiences. By leveraging iPaaS as a strategic enabler, companies can confidently navigate the complexities of M&A consolidation and position themselves for sustained growth and success in a dynamic and competitive business landscape.

Final Thought

The integration strategies for mergers and acquisitions (M&A) play a pivotal role in shaping the success and efficiency of post-consolidation operations. By focusing on consolidating systems and processes, businesses can achieve seamless integration and unlock the full potential of their M&A endeavors.

Much like an orchestra working in harmony, a well-crafted integration plan brings together diverse teams and technologies to create a unified and agile organization. Cultural alignment ensures that employees from both entities share a common vision, fostering collaboration and a sense of purpose.

Enter iPaaS, the transformative technology that serves as the backbone of integration. iPaaS seamlessly connects diverse systems, enabling data exchange and application integration. This allows for data-driven decision-making, streamlined workflows, and faster time-to-value.

At the core of successful integration lies customer-centricity. By prioritizing customer experiences and preferences, businesses can earn customer trust and loyalty. Much like a trusted partner, businesses deliver personalized and seamless interactions, strengthening the bond with their customers.

Looking to the future, technology will continue to shape the integration landscape. Advancements in AI and machine learning will enhance automation, data analytics, and predictive insights. This will enable businesses to adapt quickly to changing market dynamics and gain a competitive edge.

Embracing sustainability and corporate social responsibility will also be essential in shaping integration strategies. Businesses that prioritize responsible practices and community engagement will create positive impacts, resonating with stakeholders and reinforcing their market position.

As we move forward, the journey of integration in M&A will remain both challenging and rewarding. By embracing the strategies discussed and leveraging transformative technologies like iPaaS, businesses can navigate the complexities and uncertainties, ultimately achieving sustainable growth and long-term success. With a customer-centric approach and a commitment to continuous improvement, businesses can build a unified and resilient entity that thrives in the ever-evolving business landscape.

Aonflow iPaaS – Free for First 3 Months!

Build and run up to 1,500 transactions monthly with no cost. No payment info needed!