Data management is a critical aspect of any organization, especially in the financial sector where large volumes of sensitive information are handled daily. In recent years, Integration Key Applications of iPaaS in HealthcarePlatform as a Service (iPaaS) has emerged as a powerful solution for streamlining data management processes. In this blog, we’ll delve into how iPaaS can enhance data management specifically within financial environments, covering its key benefits, technical aspects, and best practices.

Aonflow iPaaS – Free for First 3 Months!

Build and run up to 1,500 transactions monthly with no cost. No payment info needed!

Why is iPaaS Essential in Financial Environments?

Enhanced Decision Making: In the fast-paced world of finance, timely and accurate decision-making is critical. iPaaS provides real-time access to integrated data from multiple sources, enabling financial institutions to make informed decisions based on comprehensive insights. By breaking down data silos, iPaaS ensures that decision-makers have a holistic view of information, leading to more accurate forecasts, risk assessments, and investment strategies.

Customer Experience: In today’s competitive landscape, delivering exceptional customer experiences is a top priority for financial institutions. iPaaS enables seamless integration between front-end and back-end systems, allowing organizations to provide personalized services, streamline processes, and deliver consistent experiences across channels. Whether it’s opening a new account, processing a loan application, or resolving a customer query, iPaaS ensures that interactions are smooth, efficient, and tailored to individual preferences.

Innovation and Agility: Financial markets are constantly evolving, and organizations need to innovate and adapt quickly to stay ahead of the curve. iPaaS fosters innovation by enabling rapid integration with emerging technologies such as artificial intelligence, machine learning, and blockchain. By providing a flexible and scalable platform for experimentation and deployment, iPaaS empowers financial institutions to explore new business models, launch innovative products, and respond swiftly to market changes.

Cost Savings: Traditional data integration methods often involve high upfront costs and ongoing maintenance expenses. iPaaS offers a cost-effective alternative by providing a subscription-based model with pay-as-you-go pricing. With iPaaS, financial institutions can avoid hefty investments in infrastructure and licensing fees, while also reducing operational overheads associated with manual data management processes. Additionally, iPaaS’s scalability allows organizations to align their costs with their actual usage, optimizing resource allocation and maximizing return on investment.

Risk Management: Effective risk management is essential for safeguarding financial institutions against potential threats and vulnerabilities. iPaaS enhances risk management by providing centralized visibility into data assets, enabling proactive monitoring and analysis of potential risks. By integrating data from various sources, iPaaS helps identify patterns, trends, and anomalies that could indicate fraudulent activities, compliance breaches, or operational risks. This proactive approach allows organizations to mitigate risks promptly, protect assets, and maintain trust and confidence among stakeholders.

How Does iPaaS Work in Financial Environments?

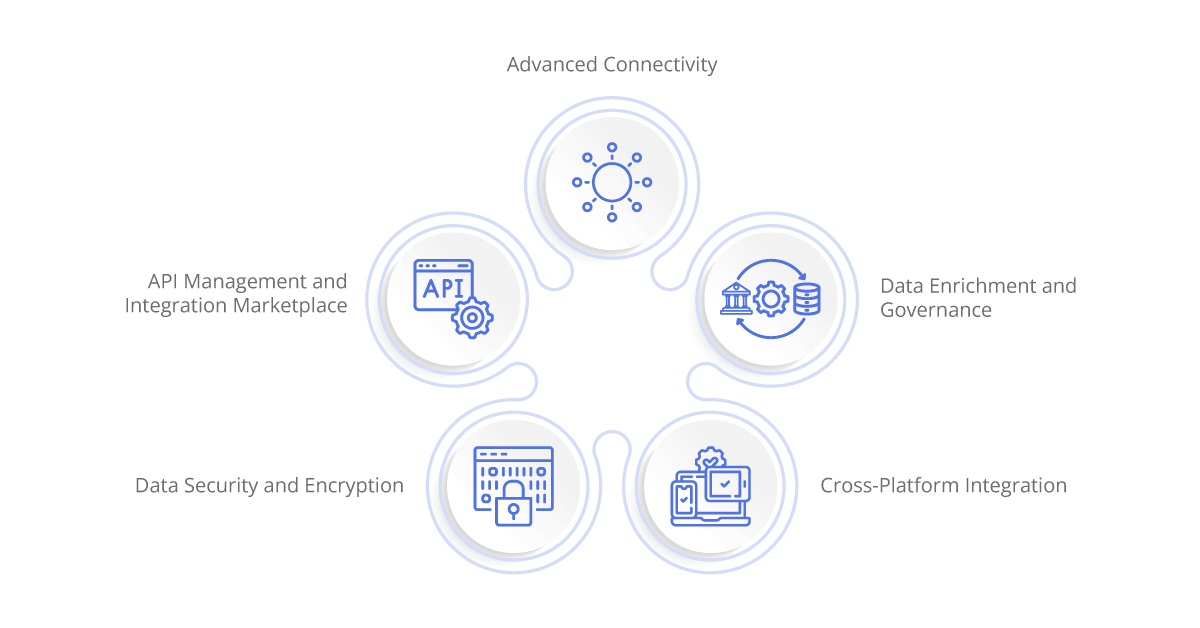

In addition to the outlined functionalities, iPaaS offers a comprehensive suite of features that streamline data management processes in financial environments:

- Advanced Connectivity: iPaaS not only provides connectors and APIs for integrating common systems like CRM software and accounting platforms but also offers advanced connectivity options for specialized financial applications. These include integration with trading platforms, portfolio management systems, risk assessment tools, and regulatory reporting platforms. By seamlessly connecting these diverse systems, iPaaS ensures that financial institutions have a unified view of their data landscape, facilitating better decision-making and compliance management.

- Data Enrichment and Governance: In addition to data transformation capabilities, iPaaS platforms often include features for data enrichment and governance. Data enrichment tools allow organizations to enhance their datasets with additional information from external sources, such as market data feeds, credit bureaus, and demographic databases. Meanwhile, built-in governance frameworks enable organizations to establish data quality standards, enforce data policies, and track data lineage. These capabilities are crucial for ensuring data accuracy, reliability, and compliance with regulatory requirements.

- Cross-Platform Integration: Financial institutions typically use a mix of on-premises and cloud-based systems to manage their operations. iPaaS platforms support cross-platform integration, allowing organizations to seamlessly connect on-premises applications with cloud-based services and vice versa. This flexibility enables financial institutions to leverage the benefits of cloud computing, such as scalability, agility, and cost-effectiveness, while still maintaining connectivity with legacy systems and infrastructure.

- Data Security and Encryption: Given the sensitive nature of financial data, security is a top priority for financial institutions. iPaaS platforms employ robust security measures to protect data in transit and at rest. This includes encryption of data transmission channels using SSL/TLS protocols, data encryption at rest using industry-standard encryption algorithms, and role-based access controls to restrict access to sensitive data. Additionally, iPaaS platforms often undergo rigorous security audits and certifications to ensure compliance with industry standards and regulatory requirements, providing peace of mind to financial organizations and their stakeholders.

- API Management and Integration Marketplace: iPaaS platforms typically offer built-in API management capabilities, allowing organizations to create, publish, and manage APIs for their internal systems and external partners. Additionally, many iPaaS providers offer integration marketplaces or app stores where organizations can discover pre-built integrations, connectors, and templates for commonly used financial applications and services. This accelerates the integration process, reduces development time and effort, and enables organizations to quickly adapt to changing business requirements and market conditions.

Benefits of iPaaS in Financial Environments

Holistic View of Data Integration

iPaaS doesn’t just connect different data sources; it creates a cohesive ecosystem where data flows seamlessly across various systems and applications. Financial institutions deal with a multitude of data sources, from transaction records to customer information and market data. iPaaS streamlines the integration of these disparate sources, ensuring that decision-makers have a comprehensive and up-to-date view of critical information. By consolidating data from CRM systems, accounting software, customer databases, and more, iPaaS enables financial institutions to make informed decisions based on a holistic understanding of their operations.

Robust Data Security Measures

In an industry where data breaches can have severe consequences, ensuring robust data security is non-negotiable. iPaaS plays a crucial role in bolstering data security measures by centralizing data management processes within a secure cloud environment.

By implementing encryption, access controls, and monitoring mechanisms, iPaaS platforms mitigate the risk of data breaches and ensure compliance with stringent regulatory requirements such as GDPR and PCI DSS. Additionally, iPaaS offers features like data masking and anonymization, further safeguarding sensitive information from unauthorized access or disclosure.

Efficiency Through Automation

Manual data management processes are not only labor-intensive but also prone to errors, leading to inefficiencies and operational risks. iPaaS addresses this challenge by automating many repetitive tasks, such as data synchronization, validation, and transformation.

By leveraging pre-built connectors, workflows, and templates, iPaaS platforms streamline data workflows, reducing the time and effort required to manage data across different systems. This automation not only frees up valuable resources but also improves the accuracy and reliability of data, enhancing decision-making and compliance management processes.

Scalability and Adaptability

Financial institutions operate in a dynamic environment where scalability and adaptability are essential for success. iPaaS offers scalability and flexibility, allowing organizations to adapt to changing business needs and scale their data management capabilities accordingly.

Whether it’s accommodating increasing volumes of data, expanding into new markets, or integrating with emerging technologies, iPaaS provides the infrastructure and tools needed to support growth and innovation. With iPaaS, financial institutions can scale their data management operations seamlessly without significant disruptions, ensuring agility and resilience in the face of evolving market conditions and regulatory requirements.

Aonflow is the leading integration platform.

You can kick-start by integrating your first-ever workflow in just a matter of minutes.

Technical Aspects of iPaaS

Comprehensive Connectivity

iPaaS offers a wide range of connectors and adapters that facilitate seamless integration between different systems and applications. These connectors are designed to support various protocols and data formats, ensuring compatibility across disparate platforms. Whether it’s connecting to legacy systems, cloud-based applications, or third-party services, iPaaS provides the necessary tools to establish robust and reliable connections, enabling smooth data exchange and interoperability.

Robust Data Transformation Capabilities

Financial data often comes in different formats and structures, making it challenging to standardize and analyze. iPaaS platforms address this challenge by offering robust data transformation capabilities. Organizations can leverage these tools to cleanse, enrich, and format data according to their specific requirements. Whether it’s data normalization, deduplication, or data enrichment, iPaaS enables organizations to transform raw data into actionable insights, improving the accuracy and reliability of decision-making processes.

Efficient Workflow Orchestration

iPaaS enables the creation of complex workflows that automate data management processes from end to end. These workflows can include tasks such as data extraction, transformation, loading, and validation, ensuring that data flows smoothly through the organization’s systems.

iPaaS platforms provide intuitive visual tools for designing and orchestrating workflows, eliminating the need for manual intervention and reducing the risk of errors. By automating repetitive tasks and streamlining data workflows, iPaaS enhances operational efficiency and productivity, allowing organizations to focus on strategic initiatives and value-added activities.

Robust Monitoring and Governance

Effective data management requires robust monitoring and governance mechanisms to ensure data quality, integrity, and regulatory compliance. iPaaS platforms provide tools for monitoring data flows in real-time, enabling organizations to track data movement, identify bottlenecks, and detect potential issues before they escalate. Additionally, iPaaS platforms often include built-in governance features that enforce data quality standards, data lineage tracking, and regulatory compliance.

By providing visibility into data flows and enforcing governance policies, iPaaS helps organizations maintain data integrity, mitigate risks, and ensure compliance with regulatory requirements such as GDPR, CCPA, and industry-specific standards like PCI DSS.

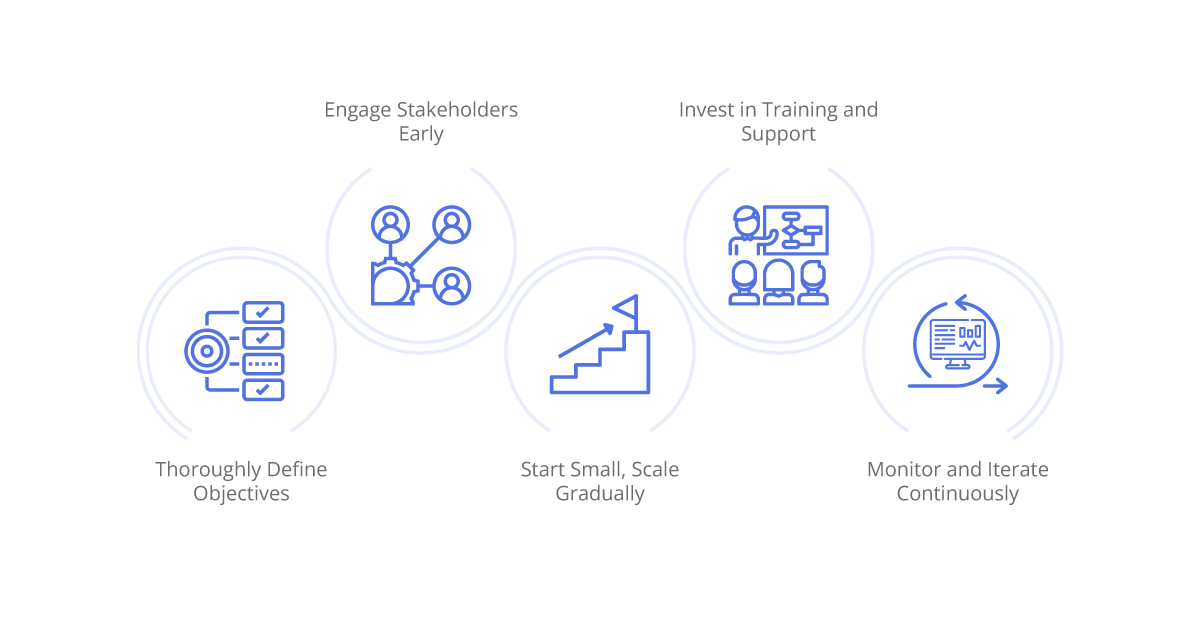

Best Practices for Implementing iPaaS in Financial Environments

Thoroughly Define Objectives

Before diving into iPaaS implementation, take the time to define clear objectives and goals. Identify the specific data management challenges you aim to address, such as improving data integration, enhancing security, or increasing operational efficiency. By clearly defining your objectives, you can align your iPaaS implementation efforts with strategic priorities and ensure that the solution meets your organization’s needs.

Engage Stakeholders Early

Successful iPaaS implementation requires buy-in from key stakeholders across the organization. Engage stakeholders from IT, finance, compliance, and other relevant departments early in the process to gather input, address concerns, and ensure that their requirements are adequately addressed. By involving stakeholders from the outset, you can build consensus, gain valuable insights, and foster collaboration throughout the implementation process.

Start Small, Scale Gradually

Instead of attempting to tackle all data management challenges at once, start with a small, manageable project and gradually scale up. This approach allows you to demonstrate the value of iPaaS and validate its effectiveness in a controlled environment. By starting small, you can minimize risks, identify potential issues early on, and make adjustments as needed before expanding the implementation to larger initiatives or additional use cases.

Invest in Training and Support

iPaaS platforms can be complex, and proper training is essential for maximizing their potential. Invest in comprehensive training programs for your team members to ensure that they have the skills and knowledge required to effectively utilize the platform. Provide hands-on training, workshops, and access to resources such as documentation and online tutorials to support ongoing learning and skill development.

Additionally, consider leveraging professional services or consulting support from the iPaaS provider such as Aonflow to ensure a smooth implementation and address any technical challenges or roadblocks.

Monitor and Iterate Continuously

Once iPaaS is implemented, ongoing monitoring and optimization are crucial for maximizing its effectiveness. Continuously monitor data flows, performance metrics, and user feedback to identify areas for improvement and optimization. Use monitoring tools and analytics dashboards provided by the iPaaS platform to track key performance indicators (KPIs), identify bottlenecks, and detect potential issues in real time. Based on insights gathered from monitoring, iterate on your processes, workflows, and configurations to drive continuous improvement and enhance the value delivered by iPaaS.

Conclusion

iPaaS offers significant benefits for enhancing data management in financial environments. By streamlining data integration, enhancing security, and improving operational efficiency, iPaaS empowers financial institutions to make better-informed decisions and drive business growth. By understanding the technical aspects and best practices associated with iPaaS implementation, organizations can unlock the full potential of this powerful technology.

Aonflow iPaaS – Free for First 3 Months!

Build and run up to 1,500 transactions monthly with no cost. No payment info needed!