Imagine you’re cleaning out a cluttered kitchen drawer. You find old receipts, expired coupons, and a random manual for a blender you no longer own. You’re not sure how these items ended up in the same place. You just know that sorting through them is a time-consuming task. Yet you keep pushing it off until the pile grows even bigger.

Many businesses face a similar situation when managing their financial data. They have receipts, invoices, and transactions scattered across various systems. Each department might track its records. Sometimes, data slips through the cracks. The result is confusion, wasted time, and more stress for your finance team.

That’s where QuickBooks integration can save the day. It keeps all your financial data in one system. It also helps you avoid double entries and reduce mistakes. In this blog, we’ll show you how to connect your financial data to QuickBooks for maximum efficiency. We’ll cover why it’s worth your time, the steps to get started, and how to ensure a seamless process. By the end, you’ll see how this simple shift can bring order to your financial world—like finally cleaning out that cluttered drawer and never letting it overflow again.

Aonflow iPaaS – Free for First 3 Months!

Build and run up to 1,500 transactions monthly with no cost. No payment info needed!

Why QuickBooks Integration Matters

In many small and medium businesses, QuickBooks is a go-to tool for accounting. You can track sales, issue invoices, and manage payroll. Yet, as your business grows, you might use extra systems for e-commerce, payroll, CRM, or project management. If these systems don’t talk to each other, your team does double work. They export data from one place and import it to another. Mistakes creep in. Nobody wants that.

Time Is Money

Every hour you or your staff spend re-entering data is an hour you can’t spend on strategic tasks. If your e-commerce site logs 100 orders a day, you don’t want to move all those records manually. An integration that updates QuickBooks automatically can save dozens of hours each week.

Data Consistency

Without integration, your sales system might show one figure while QuickBooks shows another. This mismatch can lead to confusion. You may send invoices for the wrong amount or prepare tax documents with incomplete data. QuickBooks integration keeps all numbers synced so everyone sees the same information.

Reduced Human Error

Manual data entry is error-prone. A simple typo can lead to big headaches—like charging a client the wrong amount or shipping an order to the wrong address. Integration cuts out these errors by automating data flow.

Scalability

A business that does only five invoices a day might manage with manual updates. But what if that number doubles or triples? QuickBooks integration helps you scale without extra overhead. You don’t have to hire more admin staff just to handle data.

Understanding QuickBooks: A Brief Overview

QuickBooks is an accounting software solution by Intuit. It comes in different versions: QuickBooks Online, QuickBooks Desktop, QuickBooks Enterprise, and more. Each offers core accounting features like invoicing, expense tracking, and financial reporting.

QuickBooks Online vs. Desktop

- QuickBooks Online (QBO) is cloud-based. You can log in from any web browser. It’s popular for small businesses that want access anywhere.

- QuickBooks Desktop is a traditional software you install on your computer or server. It offers strong accounting features and suits businesses that prefer local data storage.

Core Features of QuickBooks

- Invoicing and Billing: Create, send, and track invoices.

- Expense Tracking: Monitor business costs and pay bills.

- Bank Reconciliation: Match transactions with bank statements.

- Reporting: Generate profit and loss statements, balance sheets, and more.

- Payroll: Handle employee wages, tax deductions, and direct deposits (some versions).

- Inventory Management: Track items in stock, cost of goods sold, and reorder levels (in selected versions).

Integration Readiness

QuickBooks Online has an API (Application Programming Interface) that many apps use to connect. QuickBooks Desktop can integrate through third-party connectors or via the QuickBooks SDK. Knowing which version you have guided your integration approach. Cloud-based QuickBooks often pairs well with cloud apps, while desktop versions may need middleware or special connectors.

Common Financial Data Challenges Without Integration

Duplicate Data Entry

When systems aren’t integrated, staff have to re-enter the same information dozens of times. That’s time wasted, and an open invitation to mistakes.

Delayed Reporting

If the data from your e-commerce store doesn’t show up in QuickBooks for days or weeks, you can’t see real-time financial health. Delayed reporting creates the inertia of slower decisions and missed opportunities.

Conflicting Information

It is uncommon not to find a mismatch. The sales may show $10,000 in revenue for the week, while QuickBooks shows $7,000. It takes time to get to the bottom of the discrepancy. This confusion can lead to friction between departments — such as sales, finance and operations.

Auditing Hassles

Auditors require records that are consistent. If your data is spread out, you’ll have to spend more time prepping for an audit and are also at greater risk of fines for inaccuracies.

Higher Operational Costs

The snowballing issues — duplicate entries, delayed reporting and conflicting information — add up. You either pay your staff to fix them, or you lose money on a bad decision.

Key Benefits of Integrating QuickBooks With Other Systems

Reasons for Making QuickBooks and Your Other Apps Work Together

Get Real-Time Financial Visibility

And with Quickbooks receiving updates in real time from your sales, CRM, or project management tools, your financial dashboard reflects the most up-to-date figures. You can take timely actions, such as reducing expenses or providing discounts.

Streamlined Workflows

Data integrated = Less manual work With these tools, you could set up a workflow that creates a new customer entry in QuickBooks whenever there is a new client in your CRM. Once a project is completed, invoice details flow directly to QuickBooks. This eliminates busy work.

Improved Cash Flow Management

Understanding your economics in real-time is what saves you from surprises. If you realize that your payables are climbing too quickly, you can make adjustments — cut expenses or expedite receivables.

Enhanced Customer Experience

An invoice paid by a client can instantly be received. So your support staff knows whether a customer is overdue before up-selling services. With up-to-date QuickBooks data, all these touchpoints become seamless.

Moving Toward Improved Tax and Compliance Accuracy

Keeping clean books makes tax season a lot less painful. Integration minimizes the odds of missing or misreporting an expense. You can also connect automated tax compliance tools that calculate sales tax for every transaction.

Popular Integration Scenarios

E-Commerce and QuickBooks

If you have an online store (Shopify, WooCommerce) you could push order data to QuickBooks. This automatically logs every sale with the product details and customer information, eliminating manual entry. It also syncs your inventory and revenue numbers.

CRM and QuickBooks

A CRM such as HubSpot or Salesforce can integrate with QuickBooks. A sales manager finalizes a deal and an invoice is created in QuickBooks. If a customer’s contact details change in your CRM, they’ll automatically update in QuickBooks too.

Payment Processors & QuickBooks

Payment Gateways such as PayPal, Stripe, or Authorize. net processes transaction data and posts the data automatically into QuickBooks. You won’t need to reconcile the payments line by line each month.

Project Management and QuickBooks

Services such as Trello, Asana, or Basecamp can transfer time-tracking data over to QuickBooks for billing. For example, if your team tracks hours for a client job, you can convert those hours into an invoice.

Payroll Systems and QuickBooks

Tools like Gusto, ADP, or Paychex process employee payroll. Integrating them with QuickBooks makes sure that payroll expenses and tax withholdings show up in your accounting without rekeying the data.

Expense Management Apps and Quickbooks

Expense apps such as Expensify or Receipt Bank scan receipts. They can then push this data to QuickBooks for reimbursement or record-keeping, making month-end expense reconciliation easier.

Step-by-Step Guide to QuickBooks Integration

Now that you understand why QuickBooks integration is important, let’s look at the steps to take. Aside from the tools you use, these steps are largely the same, giving a general roadmap.

Clarify Your Goals

Question – What problem are you solving with this integration?

Example: Sync online sales, automate invoices or track expenses in real time

Select the Correct Integration Approach

- Built-In Connector: Some apps come with a built-in connector to QuickBooks. For instance, there’s a direct integration with Shopify that synchronizes sales to QuickBooks.

- Third-Party Connectors: Integration tools like Aonflow create a bridge between QuickBooks and scores of other apps.

- Custom API Development: If you have specific requirements, you may hire a developer to create a custom integration via the QuickBooks API.

Check Version Compatibility

- QuickBooks Online vs. Desktop: Add-ons must match your specific edition.

- Review Documentation: Read over the integration guide for each tool to see if any details about limits on QuickBooks versions or special functionality are noted.

Plan Your Data Mapping

- Identify Key Fields: Customer name, invoice number, product SKU, total price, etc.

- Map Them: Correspond each field in your external app with the applicable fields in QuickBooks.

- Set Rules: So, if “John Smith” is the customer name used by your app, and you name them this way for QuickBooks, then send QuickBooks “Smith, John” if that’s the naming convention.

Configure Your Integration

- Log In: Use your selected integration tool to log in with your credentials to connect your app to QuickBooks.

- Grant Permissions: Give data-sharing authorization. Some connectors allow you to choose read-only or read/write access.

- Setup and Configure: Determine sync intervals (real-time, hourly, daily) and define relevant filters.

Test Thoroughly

- Conduct Some Transactions: If you are integrating an e-commerce site, make a test purchase. Does it show up in QuickBooks?

- Check Logs: Certain platforms provide logs that can be reviewed for successes or errors. See if there are fields that do not match.

- Resolve Issues: Modify the mapping or configurations if necessary. Verify that taxes, shipping costs , or discounts are passed through appropriately.

Go Live

- Enable Automatic Sync After Testing: When you’re sure about the outcome of the test, turn on automated sync.

- Monitor Performance: Over the first couple of days/weeks. Record any errors.

- Train Officials: If anyone in your team handles invoices or enters data, train them to check the integrated system.

Maintenance and Updates

- Software updates: QuickBooks or your other apps are updated. Make sure your integration also needs to be updated.

- Review Mappings: Your business processes continue to evolve. Maintain a consistent integration in your area.

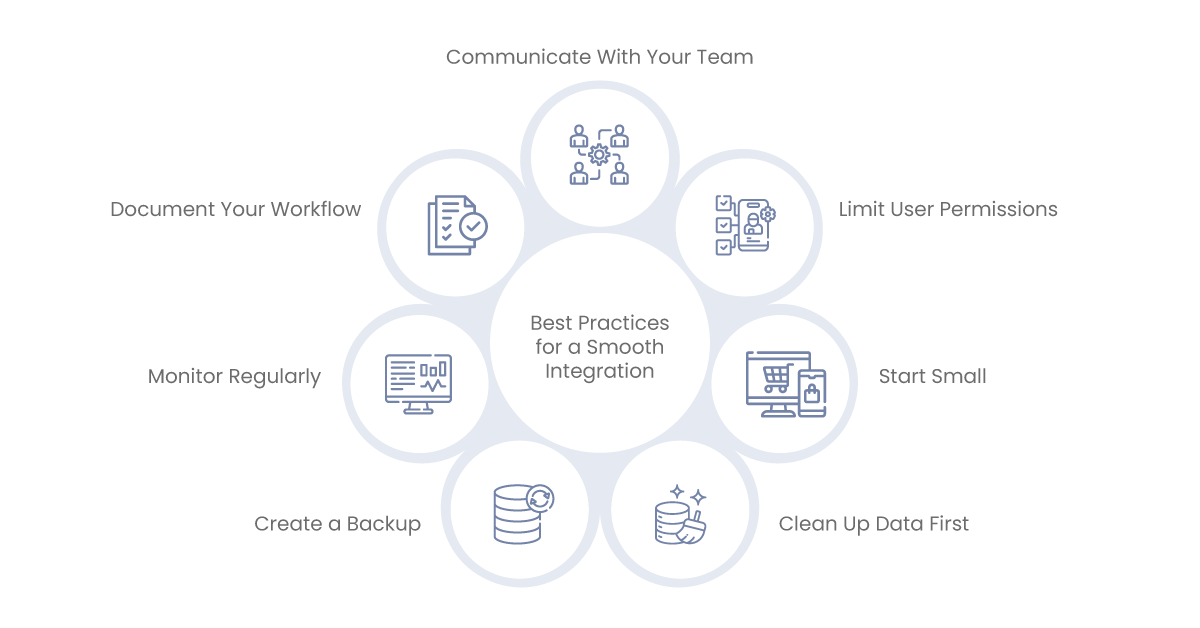

Best Practices for a Smooth Integration

Clean Up Data First

Before you connect anything, take an inventory of the data you currently have. Does the customer record have duplicates? Old product listings? Incompatible naming conventions? Now is the time to clean your data to prevent headaches down the line.

Create a Backup

If you use QuickBooks Desktop, backup your company file. If it is QuickBooks Online, export important data such as the Chart of Accounts or customer lists. Offer to restore your old data in case anything goes wrong.

Limit User Permissions

When adding new apps, provide staff access only as needed. For example, the marketing coordinator doesn’t need access to sensitive payroll information. Mistakes and security risks are lessened with proper permissions.

Document Your Workflow

Write down how data flows. For instance, “When an order is created in Shopify, it appears as an invoice in QuickBooks and has the status ‘Unpaid.’ After this, QuickBooks then marks it as Paid once payment is confirmed. “A clear process allows new employees to get up to speed quicker and avoid confusion.

Start Small

Do not attempt to integrate five apps at the same time. Start with your largest pain point — e-commerce orders, for example. Once that is working well, scale into other areas like payroll or CRM.

Monitor Regularly

Monitor for errors via dashboards or logs. When a sync fails, you want to know immediately, not two weeks later, when your books are out of whack.

Communicate With Your Team

Communicate the new process to all stakeholders. The finance team should understand how data flows, and so should the sales department and IT staff. Encourage feedback. Sometimes, the best suggestions for improvement come from the daily users.

Examples and Case Studies

Small Retailer: Your E-Commerce Accounting Made Easier

An example is a small clothing retailer that sells clothes online with Shopify and handles accounting with QuickBooks Online. The owner would manually enter sales into QuickBooks every week. Mistakes were common. With the native connector between Shopify and QuickBooks Online, daily sales are automatically synced. The owner saved 6 hours a week, reduced errors, and spent the time focusing on marketing.

Freelance Consultant: Time Tracking and Billing Automation

A freelance consultant with dozens of clients. She tracked billable time with a time-tracking tool and manually created invoices in QuickBooks Desktop every month. Some of that changed when she integrated her time-tracking app with QuickBooks, and her hours turned into invoices automatically. She was paid faster and spent less time on administrative processes.

Nonprofit Organization: Donor Management, Financials

A CRM tracked donors for a nonprofit. The finance team tracked donations and expenses using QuickBooks. There was a lag in reconciling these two systems. They connected the CRM’s donor records to QuickBooks. When donations were logged in the CRM, QuickBooks automatically logged the transaction right away. The nonprofit achieved a real-time view of its funding and saved hours spent confirming data.

Manufacturing Company: Synchronizing Inventory Between Sales Channels

For instance, a manufacturer sold through a B2B portal, Amazon, and directly. QuickBooks was used for accounting purposes. They hooked up each sales channel to QuickBooks so that any time they got a new order, their inventory counts were updated in real time. In addition, they did not often oversell items and knew the flow of profit margins by channel.

Aonflow is the leading integration platform.

You can kick-start by integrating your first-ever workflow in just a matter of minutes.

Measuring Success: How to Track ROI

Once your integration becomes life, how do you know it contributes positively?

Key Metrics

Time saved: Estimate your hourly commitment to manual entry before and after ERP integration.

Error Rate: Look for invoice disputes, missing transactions, or misapplied payments. Has the error rate dropped?

Invoice Turnaround: Do you get paid faster because invoices go out promptly?

Data Freshness: Is your QuickBooks data up to date, not a week old?

Employee Satisfaction: Integration can ease frustration. Losing staff might make staff happier doing more meaningful tasks.

Financial Impact

Labor Costs: Find out how much you spend on wages using manual data input. If integration saves 10 labor hours a week, that’s an immediate cost-saving.

Lost Sales or Cash Flow Delays: Fewer errors means fewer disappointed customers. Invoicing faster helps your cash flow.

Opportunity Cost: Unblocking time can be spent on tasks that help grow (such as marketing, product development, etc.)

Customer Feedback

If integration means inputting more accurate orders or speeding refunds, ask customers if they’ve noticed. Increased positive reviews or decreased complaints may indicate that your integration is driving happiness.

Future Trends in QuickBooks Integration

Technology changes and QuickBooks integrations will continue to change. Here’s what to watch:

AI and Machine Learning

We may have A.I.-driven tools that look at your QuickBooks data and recommend ways to reduce expenses or price products. They could also identify suspicious transactions for fraud prevention purposes.

No-Code Platforms

Integration platforms, such as Aonflow, allow non-developers to build simple workflows. Look out for features that provide a much greater degree of sophistication and almost no code, enabling small businesses to build enterprise-quality data pipelines on their limited IT budgets.

Blockchain for Secure Finance

This aspect is explored in-depth in the world of blockchain as many developers create an array of innovative blockchain solutions. This is still niche but may be relevant for businesses with high compliance needs.

Globalization and Multi-Currency Support

Integrations need to support multi-currency transactions as more and more businesses go global. QuickBooks Online already includes multiple-currency support and more advanced currency conversion capabilities might be seen in integrations.

Full-fledged Industry-specific Integrations

A specialized QuickBooks connector could be made for the healthcare, manufacturing, or real estate industries, for example. They customize flows of financial data to comply with sector-specific rules or reporting requirements.

Final Steps: Building Your Integration Roadmap

After knowing why and how of QuickBooks integration, let’s discuss a brief action plan:

Identify Your Top Pain Point

Which manual process do you spend the most amount of time or money doing?

Explore Integration Options

Use native connectors and third-party platforms to build custom APIs.

Validate Compatibility

Verify the version of QuickBooks you use. Ensure that your target app supports it.

Plan Your Data Mapping

Enumerate key fields: customers, orders, invoices, transactions, etc.

Test on a Small Scale

Test the integration of selecting some data or a single department.

Go Live Gradually

Once this is set, you may trust the setup and enable the full sync.

Monitor and Tweak

Check logs. Collect feedback from employees. Refine the workflow.

Expand

After the initial integration is validated, connect additional systems. You will see compounding benefits.

Conclusion: Tying It All Together

Remember that junk drawer from the start? iPaaS is like finally organizing that drawer for good. Moving your financial data from one system to another in a seamless way saves you time, lowers errors, and helps you get a good picture of the health of your business.

If you’ve been dreading the monthly slog of manual data entry or reconciling mismatched numbers, QuickBooks integration may be your quickest win. Begin with an easy integration — for example, your eCommerce shop or payment processor — and receive quick results. And you can connect more over time until you’ve turned your financial ecosystem into synchronicity.

Ready to get started? Start with the low-hanging fruit now — write down your top few pain points and find a QuickBooks connector that addresses them. You’ll wonder how you ever managed before, how much easier your accounting process is, and how many hours you’re able to work on something else. With a proper setup, you can concentrate on scaling your business and not on fighting with disparate datasets. That’s QuickBooks integration power at work, and it’s ready for you to unleash.

Aonflow iPaaS – Free for First 3 Months!

Build and run up to 1,500 transactions monthly with no cost. No payment info needed!